Nimiipuu Fund's financial education classes serve as empowering platforms, guiding individuals and communities toward financial stability and self-reliance.

Rooted in cultural wisdom and tailored to specific Native American contexts, these classes provide essential knowledge on budgeting, saving, investing, and managing credit. They emphasize traditional values of communal support, responsible stewardship, and long-term planning, aligning with the holistic approach to wealth often valued in Native cultures. By imparting practical financial skills within the cultural framework, these classes not only enhance individual financial well-being but also strengthen the economic resilience of Native American communities, fostering a future of prosperity and self-determination.

-

-

Trade Talks: USDA Export Credit Guarantee

April 10, 2024 | 11 am Through this program, participants gain insights into the complexities of international trade and learn how export credit guarantees can mitigate risks associated with cross-border transactions. By understanding the nuances of securing payment and managing potential defaults, Indigenous business owners can expand their reach while safeguarding their interests. This initiative…

-

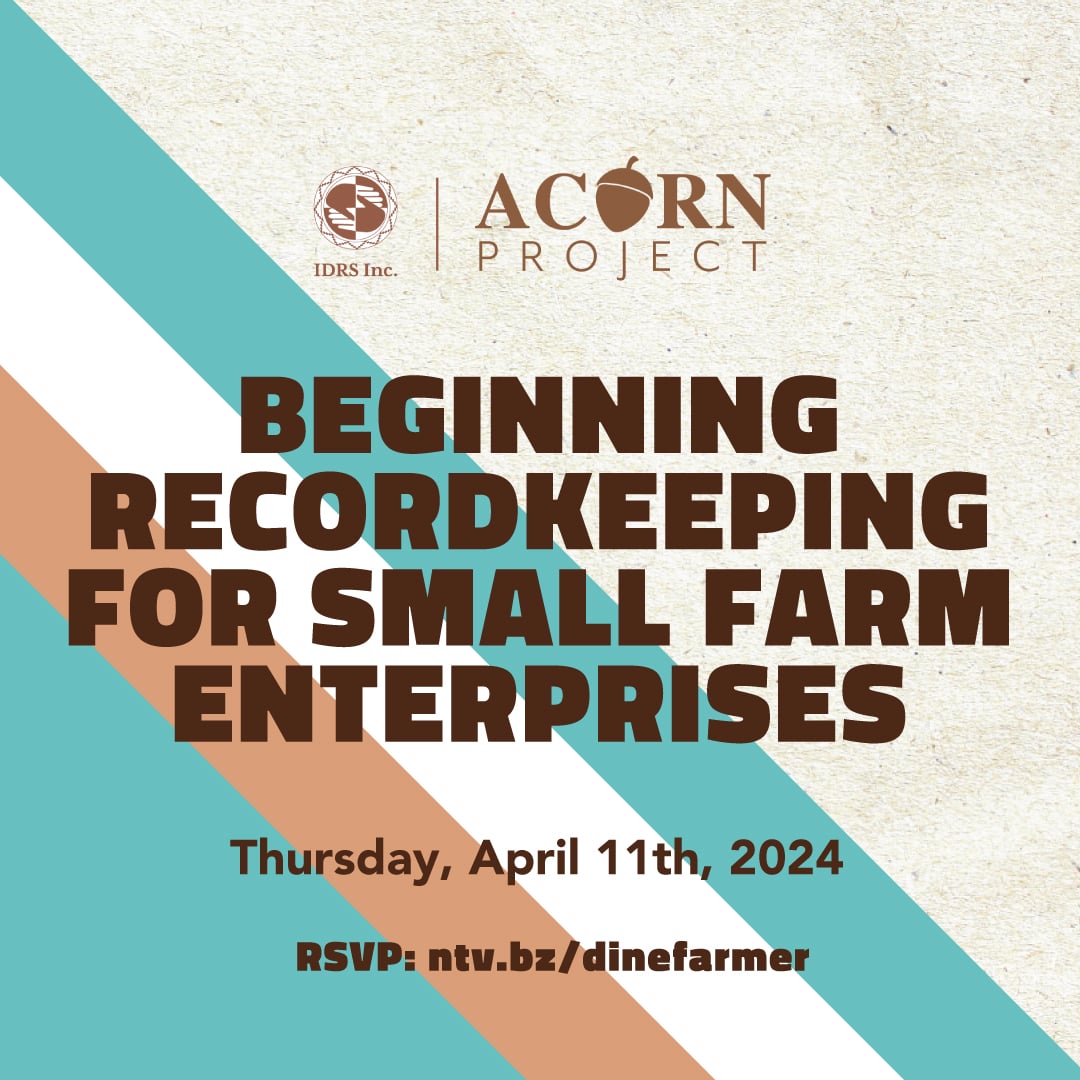

Beginning Recordkeeping for Small Farm Enterprises

Recordkeeping is important for all businesses, especially farms. Keeping good "books" will help you better plan your business in the future and allow you to accurately report on your activities whether that is to the tax man or the bank for a loan. In this webinar, we'll discuss the importance of recordkeeping, some simple methods…

-

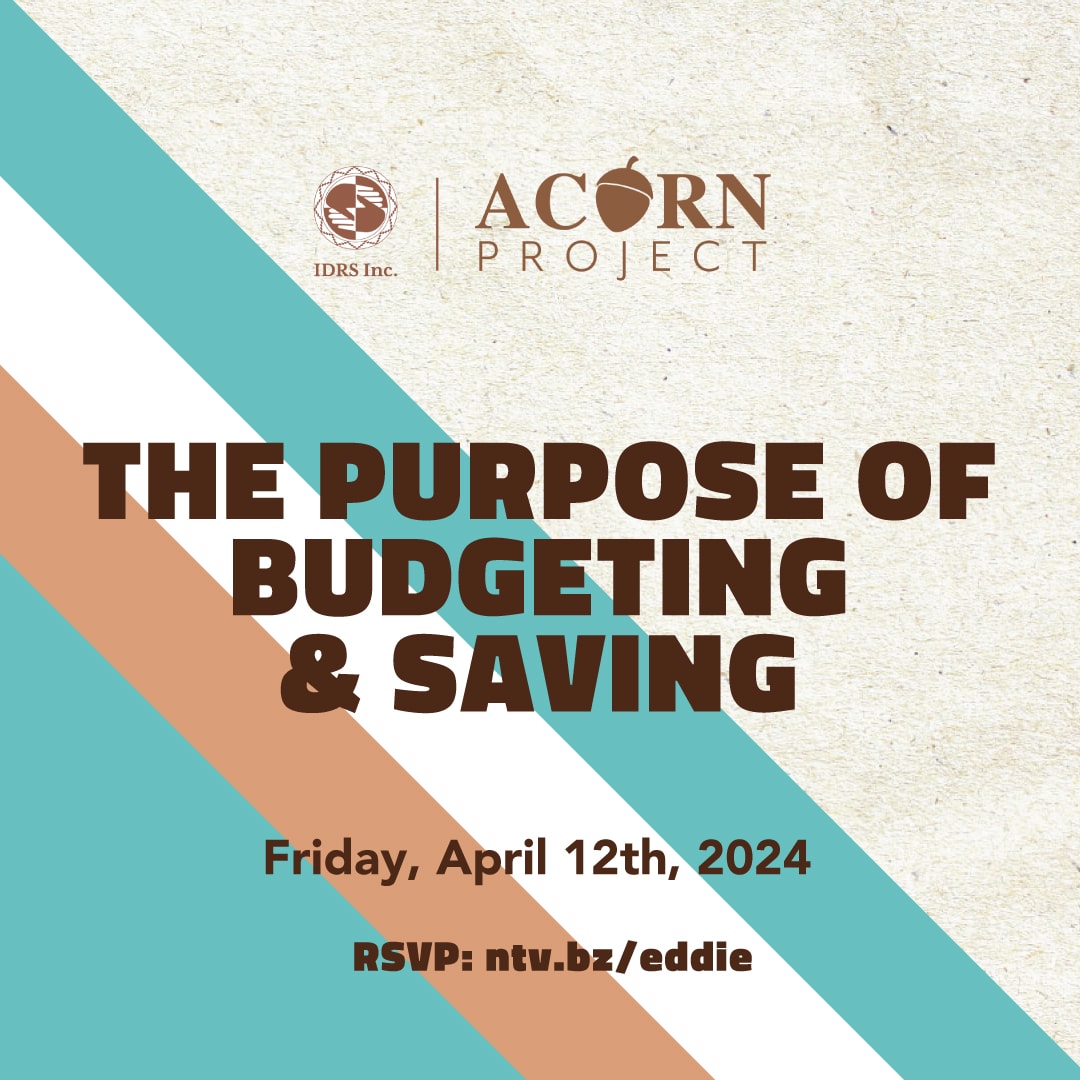

The Purpose of Budgeting & Saving

At IDRS Acorn Project, we've said for a long time that you cannot have your business's financial house in order if your personal financial house is not in order. Is your financial house organized? Even if you're good, there always new tips and techniques that can help set you up for a better tomorrow. We…

-

Money Smart for Your Small Business with SBA

Money Smart for Small Business Money Smart for Small Business is a financial education series developed jointly by the U.S. Small Business Administration (SBA) and Federal Deposit Insurance Corporation (FDIC). Monday April 15 (10 a.m.) | Planning for a Healthy Business The more you plan, the more informed you can be, which in turn helps you focus your priorities…

-

Creating a Capture Plan for a Small Business in the Government Marketplace

Capture planning is a critical process that involves identifying opportunities, evaluating the landscape, and implementing effective strategies to secure a specific business opportunity. While there is abundant information on capture planning, much of it is tailored toward large organizations with substantial human resources and established government contracts. This webinar focuses on how small businesses, despite…

-

Money Basics

Kamiah KamiahEmbark on a financial reset and seize command of your finances. Acquire essential knowledge about checking and savings accounts, unravel the intricacies of credit, enhance your credit report, and grasp the dynamics of loan rates, terms, and fees. Arm yourself against predatory lenders and discover ways we can collectively contribute to our local economy. Feel…

-

Trade Talks: Exim Bank

April 24, 2024 | 11 am Export-Import Bank of the United States (Exim Bank) is a cornerstone for Indigenous entrepreneurs seeking to navigate the intricacies of international trade. This program equips participants with a comprehensive understanding of Exim Bank's vital role in facilitating export opportunities, providing crucial financial assistance, and mitigating commercial risks for businesses…

-

Entrepreneur Success Story: InspiredNatives

On the webinar, Sarah will discuss how skills passed down from her mother and newer techniques learned from YouTube helped to develop her style and how she was able to create a business shortly after she really focused on creating.

-

Post Purchase Class

Lapwai LapwaiHomeowners facing financial challenges often find themselves in the need to recalibrate their budgets, revisit savings strategies, and address rehabilitation improvements and ongoing maintenance. The intricacies of avoiding foreclosure become a focal point, prompting individuals to consider whether refinancing is a prudent option. Navigating these aspects requires a thoughtful and informed approach to ensure the…

-

-

Incurred Cost Submissions: Contract Briefs

At the end of a defined accounting period, federal government contractors must submit actual costs incurred to DCAA. The intention of this process is for DCAA to review costs claimed to ensure they are allowable, allocable, and reasonable per FAR 31, as well as within the terms of their respective contracts. DCAA will discuss requirements…