Nimiipuu Fund's financial education classes serve as empowering platforms, guiding individuals and communities toward financial stability and self-reliance.

Rooted in cultural wisdom and tailored to specific Native American contexts, these classes provide essential knowledge on budgeting, saving, investing, and managing credit. They emphasize traditional values of communal support, responsible stewardship, and long-term planning, aligning with the holistic approach to wealth often valued in Native cultures. By imparting practical financial skills within the cultural framework, these classes not only enhance individual financial well-being but also strengthen the economic resilience of Native American communities, fostering a future of prosperity and self-determination.

-

-

2024 HHS & DOI Buy Indian Small Business Industry Day

In collaboration with the Department of Health and Human Services (HHS), Office of Small Disadvantaged Business Utilization (OSDBU), the Department of the Interior (DOI) OSDBU and the Bureau of Indian Affairs (BIA), the Indian Health Service will co-host and participate in the inaugural Buy Indian Native American Small Business Industry Day Event, scheduled for May…

-

Environmental Protection Agency (EPA) SBIR/STTR Program

In this class, you'll learn about how the EPA SBIR/STTR programs support small businesses in developing innovative solutions to environmental challenges. Whether you're a startup, entrepreneur, or researcher, this session will provide valuable insights into the funding opportunities available through these programs.

-

Steps to Starting an Art Business

Starting a business involves planning, making key financial decisions, and completing a series of legal activities. This short workshop will introduce you to starting your own art business by going over the 10 steps you need to do, including licenses and permits, registering your business and more. Practical, down-to-earth information with a Q&A time.

-

Ways to Take Payment

Taking payment seems simple. Somebody gives you cash and you give them the product. But what happens when cash isn’t an option? Are you able to take payment from debit and credit cards, or even through payment apps like Venmo? Join us for an insightful webinar where we’ll explore a variety of payment methods and…

-

Estate Planning Workshop

Clearwater River Casino Event Center 17500 Nez Perce Road, Lewiston, IDJoin us for a complimentary dinner at our workshop exclusively for Nez Perce Tribal members. Discover the opportunity to collaborate with a Legal Intern this summer to draft, finalize, and sign your Last Will & Testament. Gain valuable insights on preparing for your consultation with the Legal Intern. Remember, your will is only legally binding…

-

Credit Score Management for Small Business

Nez Perce Tribe Boards and Commissions Building 210 A Street, Lapwai, IdahoJoin us for an informative session designed to empower small business owners with the knowledge to effectively manage and improve their credit scores. This workshop will cover essential topics including understanding credit scores, practical tips for maintaining a healthy score, and strategies to enhance your business's financial credibility.

-

Financial Management

While having a fantastic product and top-notch marketing is essential, it’s equally crucial to understand your financial health. Without the knowledge of budgeting, recordkeeping, and accurate cash flows, your business could face uncertainty. This workshop will help you learn to craft a solid startup budget, forecast cash flows, and expertly analyze your break-even point. In…

-

NW Native CDFI Summit & Gala

Join Northwest Native Development Fund in creating space to join other Native CDFI practitioners to discuss important internal challenges and successes, as well as network and meet new faces. The second evening will celebrate NNDF's Small Business Awards at the Native Business Awards Gala and Auction. Special rates available at the CDA Casino hotel. Call…

-

Introduction to Investing: Financial Literacy with Eddie Torres

At IDRS Acorn Project, we've said for a long time that you cannot have your business's financial house in order if your personal financial house is not in order. Is your financial house organized? Even if you're good, there always new tips and techniques that can help set you up for a better tomorrow. We…

-

-

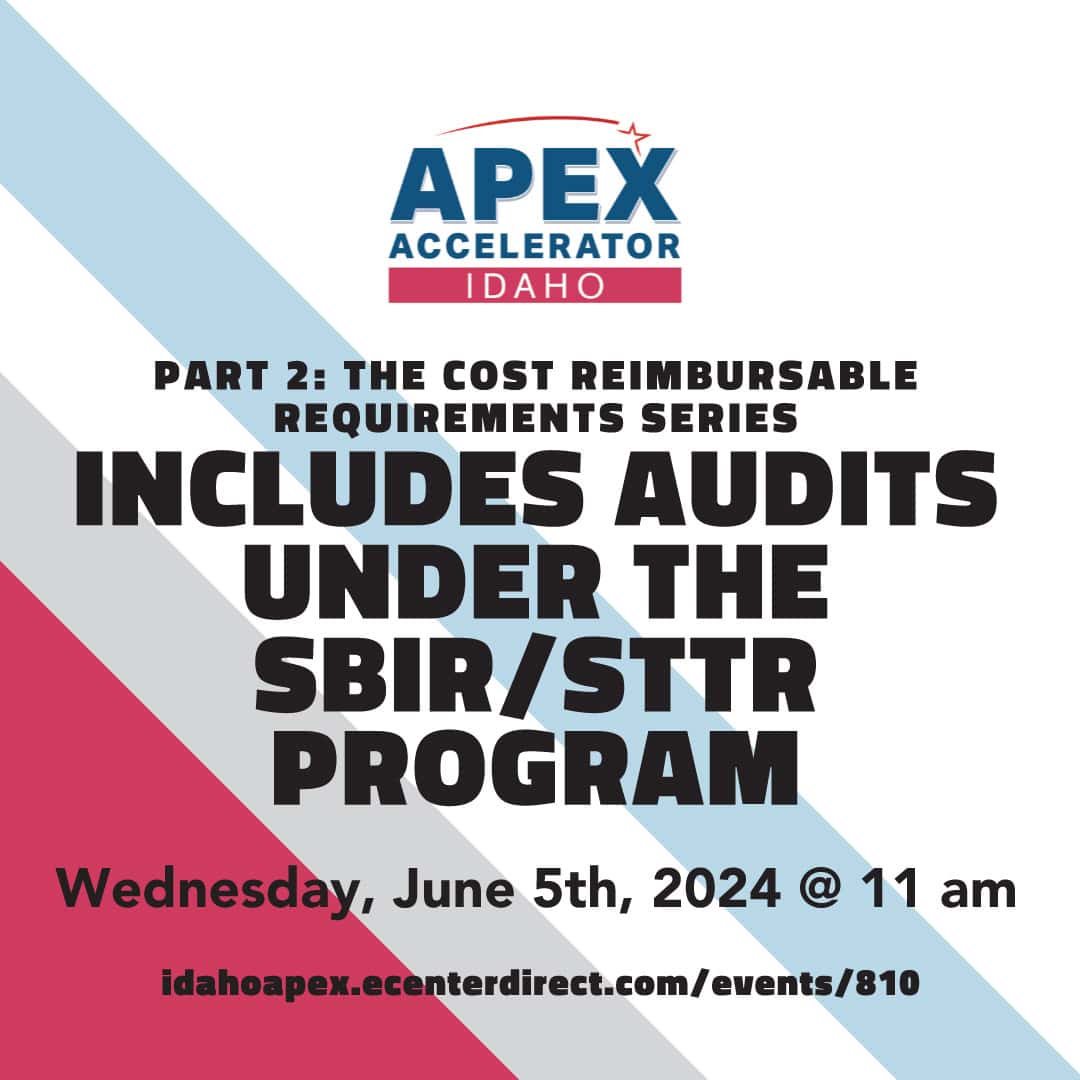

Part 2 of 2 of the Cost Reimbursable Requirements Series includes Audits Under the SBIR/STTR Program

Your local APEX Accelerator and the National APEX Accelerator Alliance (NAPEX) are excited to announce the upcoming DCAA Cost Reimbursable Requirements Series. Part 2 of 2 of the Cost Reimbursable Requirements Series includes Audits Under the SBIR/STTR Programs from a DCAA Perspective and Accounting System Requirements. Each year, over 5,000 contracts totaling well over $3.2…