Nimiipuu Fund's financial education classes serve as empowering platforms, guiding individuals and communities toward financial stability and self-reliance.

Rooted in cultural wisdom and tailored to specific Native American contexts, these classes provide essential knowledge on budgeting, saving, investing, and managing credit. They emphasize traditional values of communal support, responsible stewardship, and long-term planning, aligning with the holistic approach to wealth often valued in Native cultures. By imparting practical financial skills within the cultural framework, these classes not only enhance individual financial well-being but also strengthen the economic resilience of Native American communities, fostering a future of prosperity and self-determination.

-

-

Credit Score Management for Small Business

Nez Perce Tribe Boards and Commissions Building 210 A Street, Lapwai, IdahoJoin us for an informative session designed to empower small business owners with the knowledge to effectively manage and improve their credit scores. This workshop will cover essential topics including understanding credit scores, practical tips for maintaining a healthy score, and strategies to enhance your business's financial credibility.

-

Financial Management

While having a fantastic product and top-notch marketing is essential, it’s equally crucial to understand your financial health. Without the knowledge of budgeting, recordkeeping, and accurate cash flows, your business could face uncertainty. This workshop will help you learn to craft a solid startup budget, forecast cash flows, and expertly analyze your break-even point. In…

-

NW Native CDFI Summit & Gala

Join Northwest Native Development Fund in creating space to join other Native CDFI practitioners to discuss important internal challenges and successes, as well as network and meet new faces. The second evening will celebrate NNDF's Small Business Awards at the Native Business Awards Gala and Auction. Special rates available at the CDA Casino hotel. Call…

-

Introduction to Investing: Financial Literacy with Eddie Torres

At IDRS Acorn Project, we've said for a long time that you cannot have your business's financial house in order if your personal financial house is not in order. Is your financial house organized? Even if you're good, there always new tips and techniques that can help set you up for a better tomorrow. We…

-

-

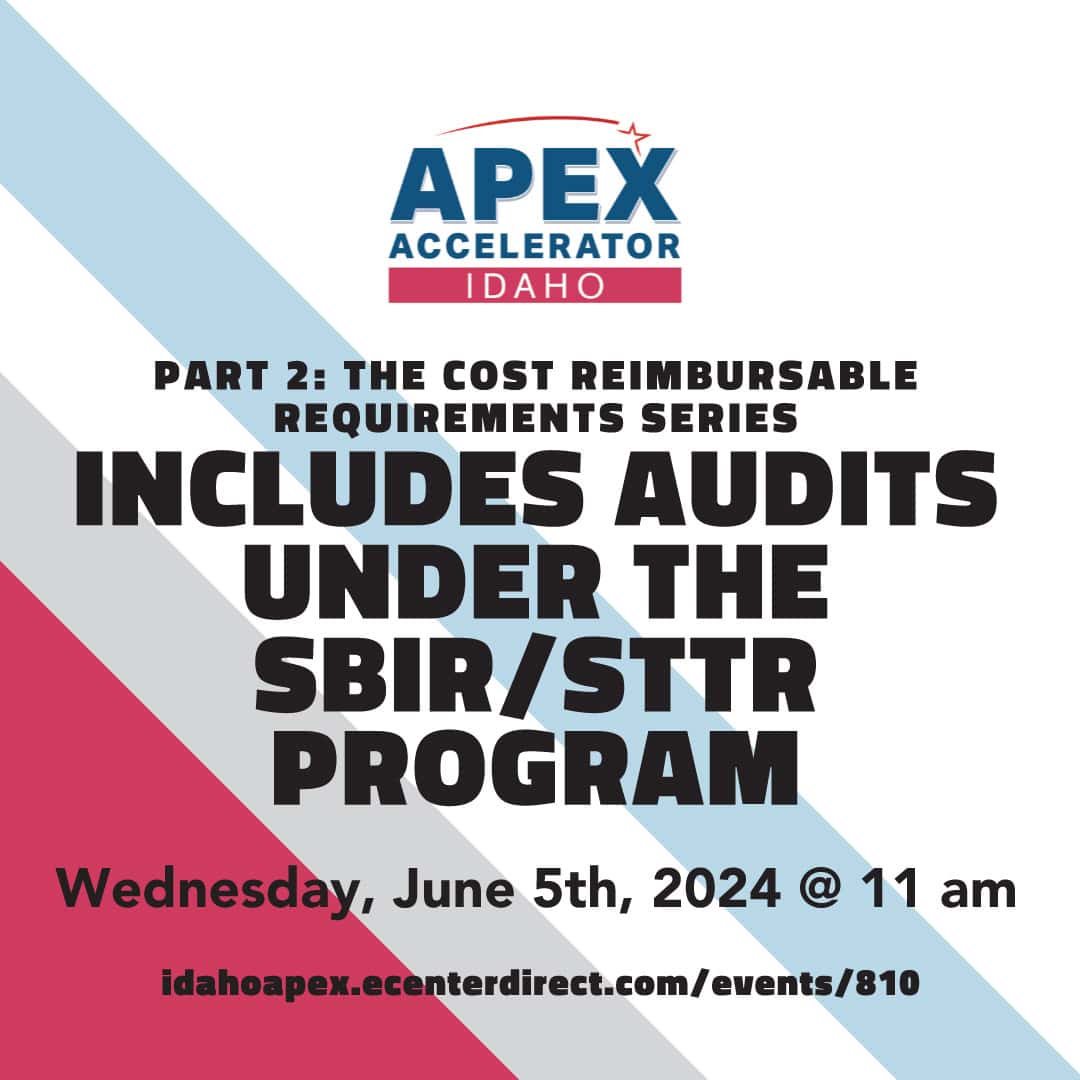

Part 2 of 2 of the Cost Reimbursable Requirements Series includes Audits Under the SBIR/STTR Program

Your local APEX Accelerator and the National APEX Accelerator Alliance (NAPEX) are excited to announce the upcoming DCAA Cost Reimbursable Requirements Series. Part 2 of 2 of the Cost Reimbursable Requirements Series includes Audits Under the SBIR/STTR Programs from a DCAA Perspective and Accounting System Requirements. Each year, over 5,000 contracts totaling well over $3.2…

-

Home Fair

Lapwai LapwaiEmbark on a comprehensive exploration of homeownership at our upcoming Home Fair, where a wealth of essential topics will be covered. Dive into the intricacies of Home Repairs & Maintenance, gaining valuable insights to keep your living space in top-notch condition. Delve into Home Safety measures to safeguard your cherished space. Explore diverse Financing options…

-

AIANTA/USFS NATIVE Act Request for Proposals for FY 2024

AIANTA and the U.S. Forest Service will host an informational webinar regarding the Request for Proposals for NATIVE Act Tribal Projects and Initiatives on or Adjacent to U.S. Forest Service Managed Lands for FY 2024. The webinar will include a panel of past grantees and a question and answer session specific to types of projects,…

-

Meet the Agency: Environmental Protection Agency (EPA)

Online and Free! The Small Business Innovation Research program provides seed money to small businesses that are developing new technologies that might be of interest to federal agencies. This training will be of particular interest to businesses seeing R&D funding in climate change; emergency response, land, waste and clean-up; greener living; chemicals, toxics and pesticides;…

-

Funding Your Business Needs with SBA Programs

Whether it is $500 or $5 million, the SBA has programs to help your business secure the funding it needs to start, grow, and expand. The SBA helps small businesses get funding through a number of loan programs, setting guidelines for lenders and reducing lender risk. These SBA-backed loans make it easier for small businesses…

-

The Academy, Workplace Conduct

Join us for a Workplace Conduct training sponsored by The Academy at Bank of America. This workshop is ideal for learners looking to grow their understanding of why workplace professionalism is important as well as gain tools to foster strong working relationships and achieve professional success. The Academy is Bank of America’s training and professional…