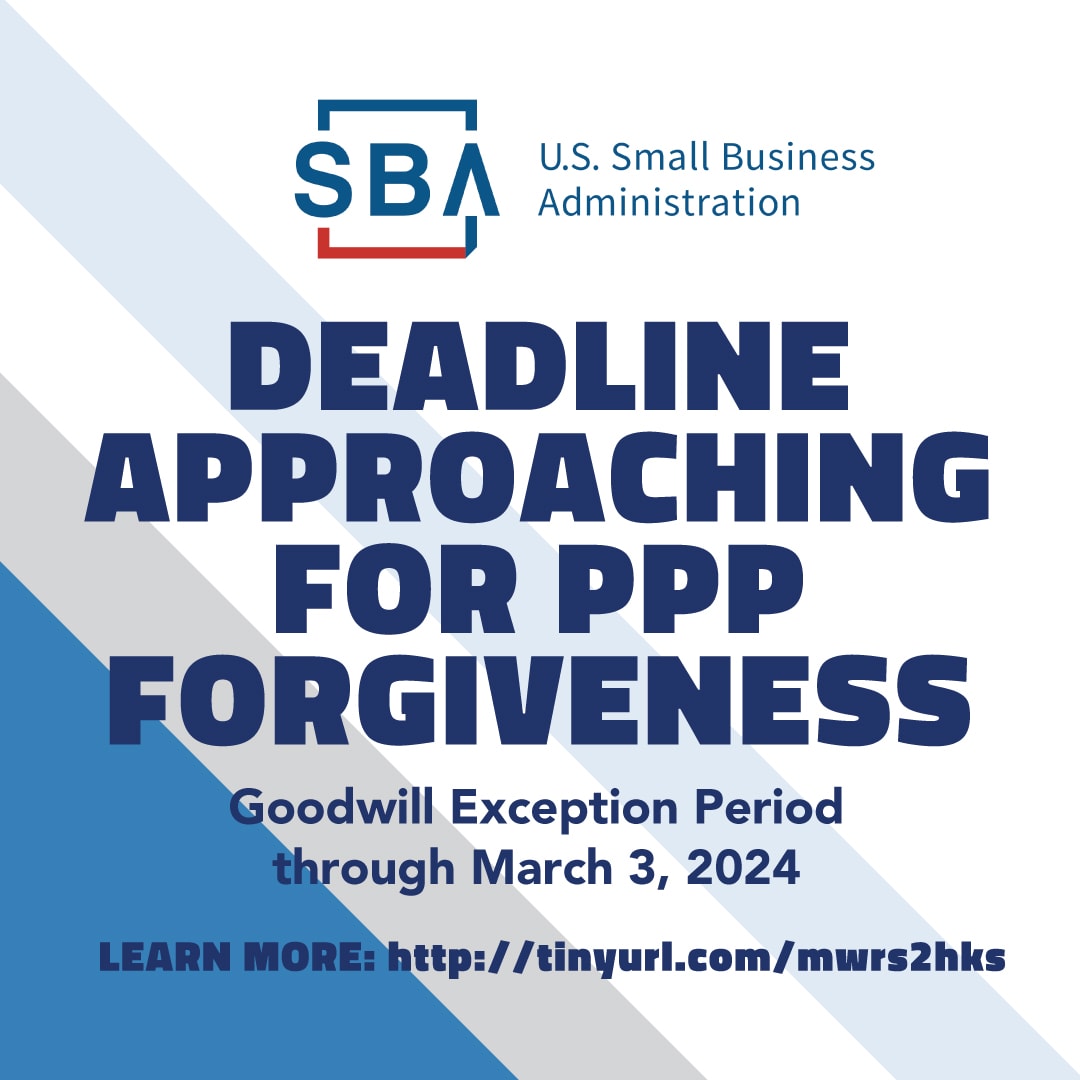

Deadline Approaching for PPP Forgiveness

As you may have already heard through other channels, SBA recently announced an important deadline extension for certain defaulted PPP and COVID EIDL borrowers that could impact many entrepreneurs and small business owners in our communities.

Borrowers who have a defaulted PPP or a COVID EIDL loan under $100,000 (but have not yet been referred to Treasury) have through March 3, 2024, to take action. The deadline reflects a 60-day goodwill exception period dating back to January 1 to allow borrowers more time to get in good standing with the SBA. After this period, impacted borrowers will be referred to both the IRS and Treasury.

Small business borrowers who are referred to Treasury and IRS for collection may face significant consequences, including:

- Negative impact on credit scores;

- Withholding of future state and federal tax refunds and any potential federal government funding (such as social security); and,

- Referral of the loan to private debt collectors to pursue repayment, who may use tactics like wage garnishment.

We are aware that borrowers may be coming to your offices for help or may be skeptical about being contacted. I wanted you to know there is a national awareness campaign and District Offices are helping to spread the word about the upcoming deadline and providing guidance on what clients can do to address their cases.

Our Actions

- Emailing stakeholders and lenders, either as a standalone email blast or in a scheduled newsletter.

- Spreading the word about upcoming informational webinars. You can find a link to all upcoming webinars and how to sign up here.

- Posting on social media channels.

- Sharing information about the deadline in upcoming meetings.

- Calling potentially impacted borrowers.

- Sharing information on how to report ID theft or fraud if that is what they claim.

On a national scale, robo calls started going out for both COVID EIDL and PPP borrowers in these situations.

Locally, we are responsible for contacting the PPP borrowers in the Boise District that will be impacted if they don’t apply for forgiveness or pay their PPP loans as agreed. We started with emails last week, are following up with direct calls this week, and are conducting several webinars on how to submit for forgiveness through the MySBA Loan Portal.

For EIDL, borrowers are instructed to contact the COVID EIDL Servicing Center. COVID-19 EIDL Customer Service: 833-853-5638 (TTY:711), email [email protected], or send a message through the MySBA Loan Portal.Additional information about Managing the COVID EIDL loans can be found: Manage your EIDL | U.S. Small Business Administration (sba.gov).

Attached is a one-page guide on PPP and EIDL actions that borrowers can take. If borrowers are stuck on what steps to take in the PPP forgiveness process, you are welcome to direct them to [email protected]. We monitor this email regularly and will reach back out to them to try to provide materials or direct them to appropriate servicing offices.