Nimiipuu Fund's financial education classes serve as empowering platforms, guiding individuals and communities toward financial stability and self-reliance.

Rooted in cultural wisdom and tailored to specific Native American contexts, these classes provide essential knowledge on budgeting, saving, investing, and managing credit. They emphasize traditional values of communal support, responsible stewardship, and long-term planning, aligning with the holistic approach to wealth often valued in Native cultures. By imparting practical financial skills within the cultural framework, these classes not only enhance individual financial well-being but also strengthen the economic resilience of Native American communities, fostering a future of prosperity and self-determination.

Events

-

-

Are You Ready to Export?

Embark on your export journey with confidence! Discover your partners and unlock essential resources and tools to support you every step of the way. Join us for an enlightening webinar where you’ll learn that expanding into international trade doesn’t have to be a solo experience. The Washington SBDC International Trade Certified Business Advisors are NASBITE…

-

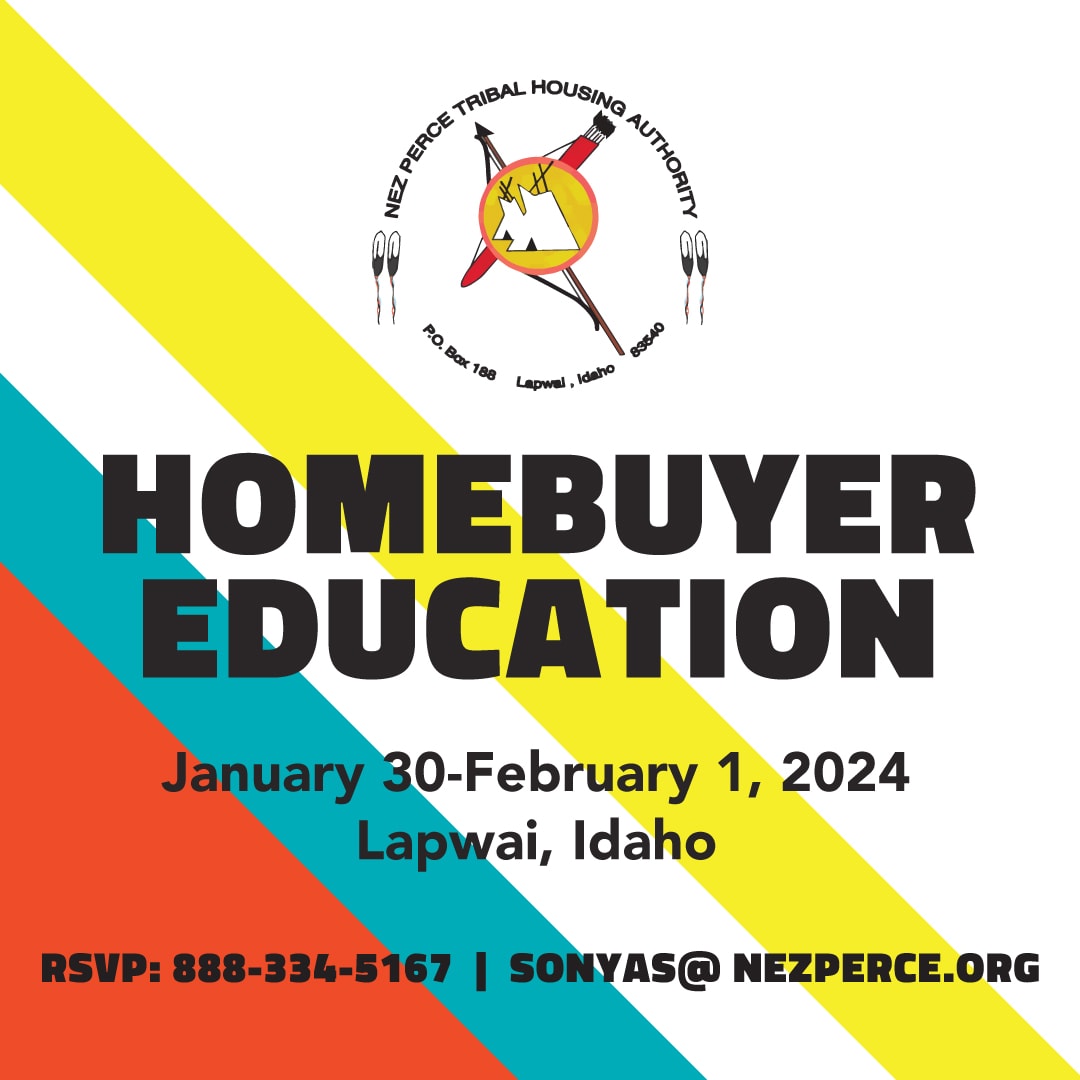

Homebuyer Education

Lapwai LapwaiDiscover the intricacies and advantages of home ownership, along with the associated responsibilities and maintenance considerations. This comprehensive guide covers a range of topics, including the significance of budgeting and savings, strategies for improving credit, calculating affordability, navigating tribal land issues, exploring program and loan options, understanding the steps involved in the loan and construction…

-

-

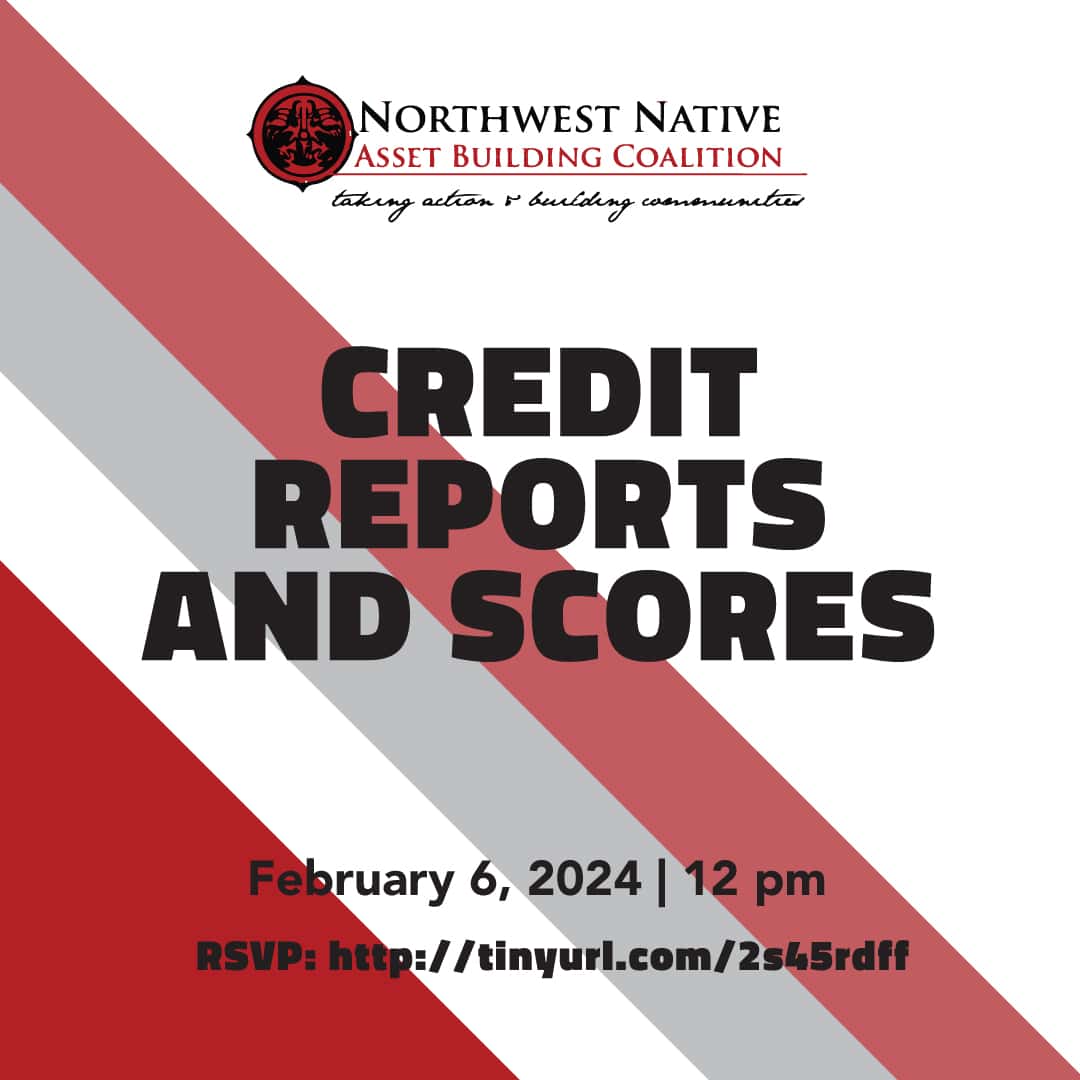

Credit Reports and Scores

From employment possibilities to the rates we pay for insurance, our credit has direct impacts on our financial health. Attend this course to gain skills in managing, protecting, building, and even rebuilding credit. Learn what information credit bureaus use to calculate your credit score and gain the knowledge you need for a secure financial future.…

-

Redesign Your Website

When did you last look at your business’s website? Or perhaps you are still trying to develop one? Websites remain an incredibly popular destination for site traffic. When you add up all of the functions and ways they can work for and represent your business, nothing works harder online than a professional website. It can…

-

Business Risk Management: LLC under Tribal Law

Come join us for the Business Risk Management + LLC under Tribal Law for Small Businesses Webinar in partnership with the Small Business Legal Clinic. Shanna has served several tribal governments while working at a firm in Washington, D.C., including advising tribes on economic development matters such as trademarks for tribal enterprises, contracts that protected…

-

Marketing Plan 101: Create Your Roadmap To Success

Are you overwhelmed by all the choices for your marketing your business in the new year? Not sure where your time is best spent? Are you following what everyone else is doing and hope it works for you too? A well-executed marketing plan will help you: Define your business with SWOT Analysis (Strengths, Weaknesses, Opportunities…

-

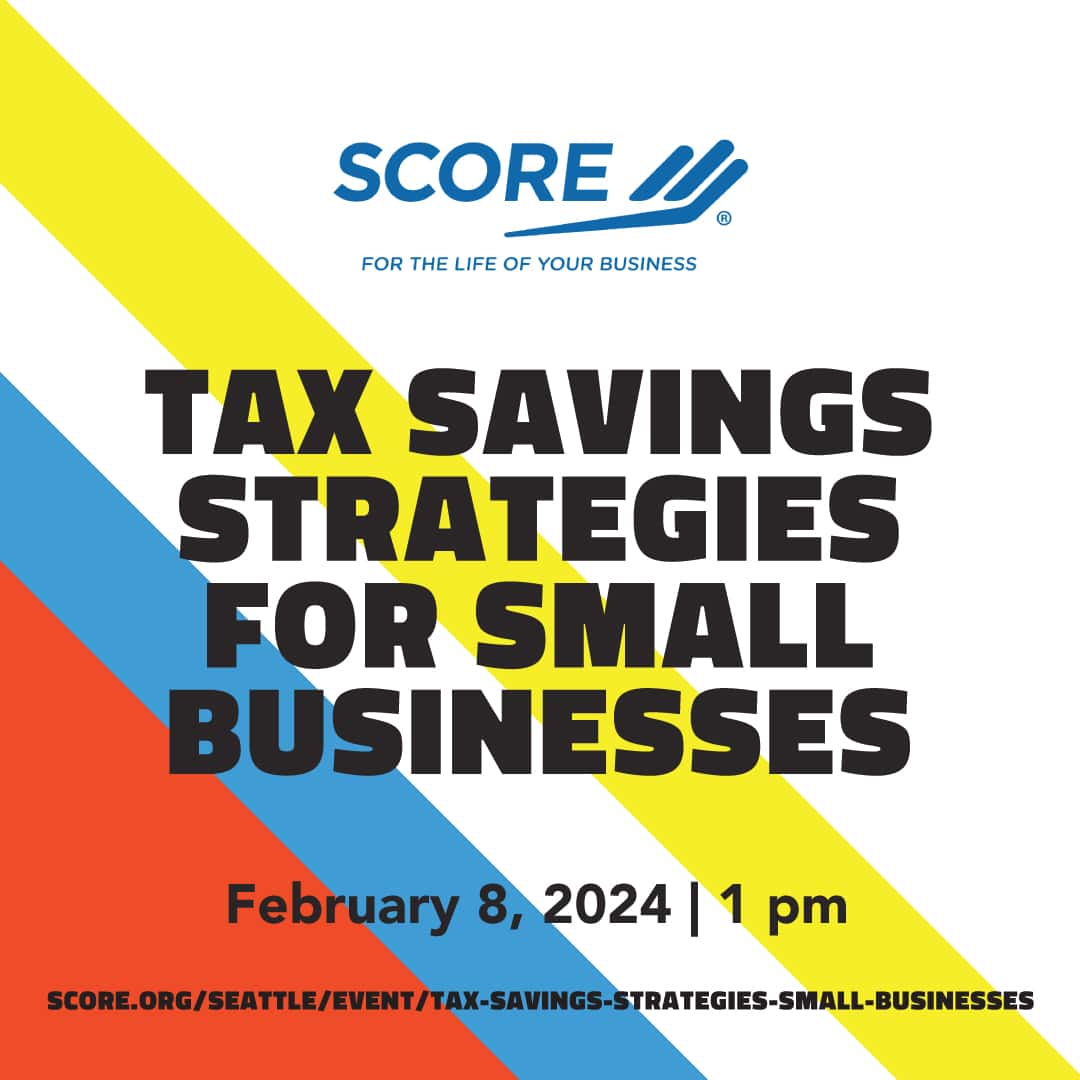

Tax Savings Strategies for Small Businesses

This workshop focuses on Federal tax-saving strategies that work best for small businesses. It covers topics such as electing S-Corporation status with the IRS, maximizing the deduction for business use of the home, demonstrating two ways to compute the deduction for the business use of a personal vehicle, providing examples of seven different retirement plans,…

-

Strategies to Identify and Reach Your Target Customers

In this Marketing workshop, we start by helping you identify your target market. These are your best potential customers and knowing them helps you create a better product or service. It also makes all your promotional efforts more focused and effective. We show you how to finalize the design of your product or service and make sure…

-

Debt Repayment Options & Debt Collections

Looking for ways to manage finances or consolidate your debts? Attend this class where we will look at ways for getting out of debt. We explore aspects of the personal budget and focus on using a spending plan to pay down debts in a systematic manner. We also explore the pros and cons of other…

-

Loan Programs: Funding for Working Capital

Join staff from the SBA Seattle District office to learn how the SBA 7(a) Loan Guaranty Program can be used to meet your company's working capital needs. During this free webinar we will discuss: Allowable uses of working capital funds The various loan programs available for working capital The loan structuring process for each program…